Schedule D Instructions 2024 Deductions

Schedule D Instructions 2024 Deductions – Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2024. . Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024. Taxpayers who are 65 and older, or are blind, are eligible for an additional standard deduction. .

Schedule D Instructions 2024 Deductions

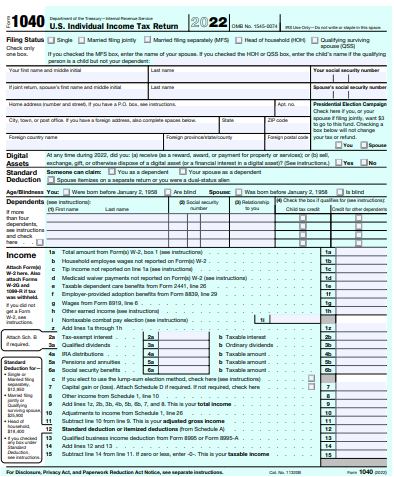

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIRS Releases 2024 Tax Brackets, Retirement Contribution Limits

Source : www.valleywealthadvisors.com2023 Instructions for Schedule D

Source : www.irs.govForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.za1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comInstructions for Form 8995 A (2023) | Internal Revenue Service

Source : www.irs.govDiscover how new IRS rules affect San Antonio taxpayers’ Deductions

Source : hoodline.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule D Instructions 2024 Deductions All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . You can save thousands of dollars by taking advantage of the various deductions and tax credits available to filers. Although sometimes referred to interchangeably, deductions and credits are two .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)